Show

What is Factory Overhead?Factory overhead is the costs incurred during the manufacturing process, not including the costs of direct labor and direct materials. Factory overhead is normally aggregated into cost pools and allocated to units produced during the period. It is charged to expense when the produced units are later sold as finished goods or written off. The allocation of factory overhead to units produced is avoided under the direct costing methodology, but is mandated under absorption costing. The allocation of factory overhead is required when producing financial statements under the dictates of the major accounting frameworks. Examples of Factory OverheadExamples of factory overhead costs are noted below:

The range of possible factory overhead costs can be quite extensive, depending upon the size and complexity of a factory operation and the level of detail at which costs are recorded. Factory Overhead VariancesAfter factory overhead is allocated to inventory, the amount actually allocated will vary from the standard amount that had been budgeted to be allocated. This difference is caused by either a spending variance or an efficiency variance. The spending variance occurs because the actual amount of factory overhead expenditure incurred in the period was different from the standard amount that had been budgeted at some point in the past. The efficiency variance occurs because the the amount of units to which the factory overhead was allocated varied from the standard amount of production that had been expected when the allocation rate was set up. Factory Overhead Best PracticesThe use of factory overhead is mandated by accounting standards, but does not bring real value to the understanding of overhead costs, so a best practice is to minimize the complexity of the factory overhead allocation methodology. Ideally, there should be a small number of highly aggregated factory overhead accounts that are pooled into a single cost pool, and then allocated using a simple methodology. Also, the amount of factory overhead analysis and recordation work can be mitigated by charging all immaterial factory costs to expense as incurred. Terms Similar to Factory OverheadFactory overhead is also known as manufacturing overhead or manufacturing burden. Standard Costing is an integral part of the costing process within an organisation. It is a process that helps compare the revenues and actual cost of producing a good or service with the actual results to measure the variance and understand its reasons. Below is a list of multiple-choice questions and answers on Standard Costing to help students understand the importance of this process in a

company’s overall decision making.

Answer: a Answer: a Answer: c Answer: d Answer: a Answer: a Answer: b Answer: d Answer: c Answer: a Answer: b Answer: d Answer: d Answer: b Answer: a Answer: a Answer: b Answer: c Answer: a Answer: b Also See:

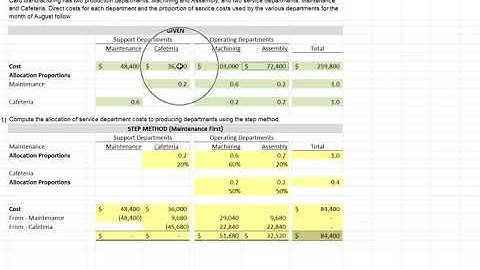

When standard costs are used factory overhead is assigned?When standard costs are used, factory overhead is assigned to products with a predetermined standard overhead rate. Companies promoting continuous improvement strive to achieve practical standards rather than ideal standards. A cost variance is the difference between actual cost and standard cost.

For which standard cost is used Mcq?Standard cost is used to identify the variances between the actual cost incurred and the cost that should have occurred to produce the goods in normal conditions. Standard cost is a predetermined cost.

Why is fixed overhead in the master budget the same as fixed overhead in the flexible budget?Fixed overhead in the master budget is the same as fixed overhead in the flexible budget because fixed costs do not change with changes in units produced.

For which standard cost is used?Standard costing, also known as standard cost accounting, is used to set budgets and plan for future expenses. It is a type of cost accounting mainly used in the manufacturing sector because it is easier to allocate costs directly to products being produced.

|

zusammenhängende Posts

Werbung

NEUESTEN NACHRICHTEN

Werbung

Populer

Werbung

Urheberrechte © © 2024 ketiadaan Inc.